In a recent issue of Kiplinger, my thoughts on Initial Public Offerings (IPOs) were briefly highlighted. While it was an honor to be quoted, the snippet couldn’t capture the full breadth of my perspective on this often-hyped, misunderstood area of investing. Many seasoned investors might know the basic mechanics of an IPO, but there’s so much more to unpack when considering them as viable investment opportunities.

As someone who regularly advises individuals working in companies experiencing significant growth, I understand the nuance and intricacy that goes into making these decisions. It’s precisely this depth of understanding I wish to share. Here, I delve deeper into the intricacies of investing in IPOs, offering insights not just on their allure but, perhaps more crucially, on their potential pitfalls.

The Risks of Jumping Into IPOs Too Early

The allure of investing in IPOs often lies in the promise of substantial early returns and the excitement of backing a fresh contender in the market – along with a healthy dose of FOMO (“fear of missing out”). The media especially likes to highlight the IPO winners and extraordinary gains of investing in the next Amazon or Google. However, this enthusiasm can be misleading and potentially hazardous to your wealth.

The reality is that the majority of companies that have gone public in the past two decades were unprofitable at the time of their IPO. This is an especially tough business environment for unprofitable businesses as we move away from low interest rates, which previously acted as a shield to the actual health and fundamentals of the company.

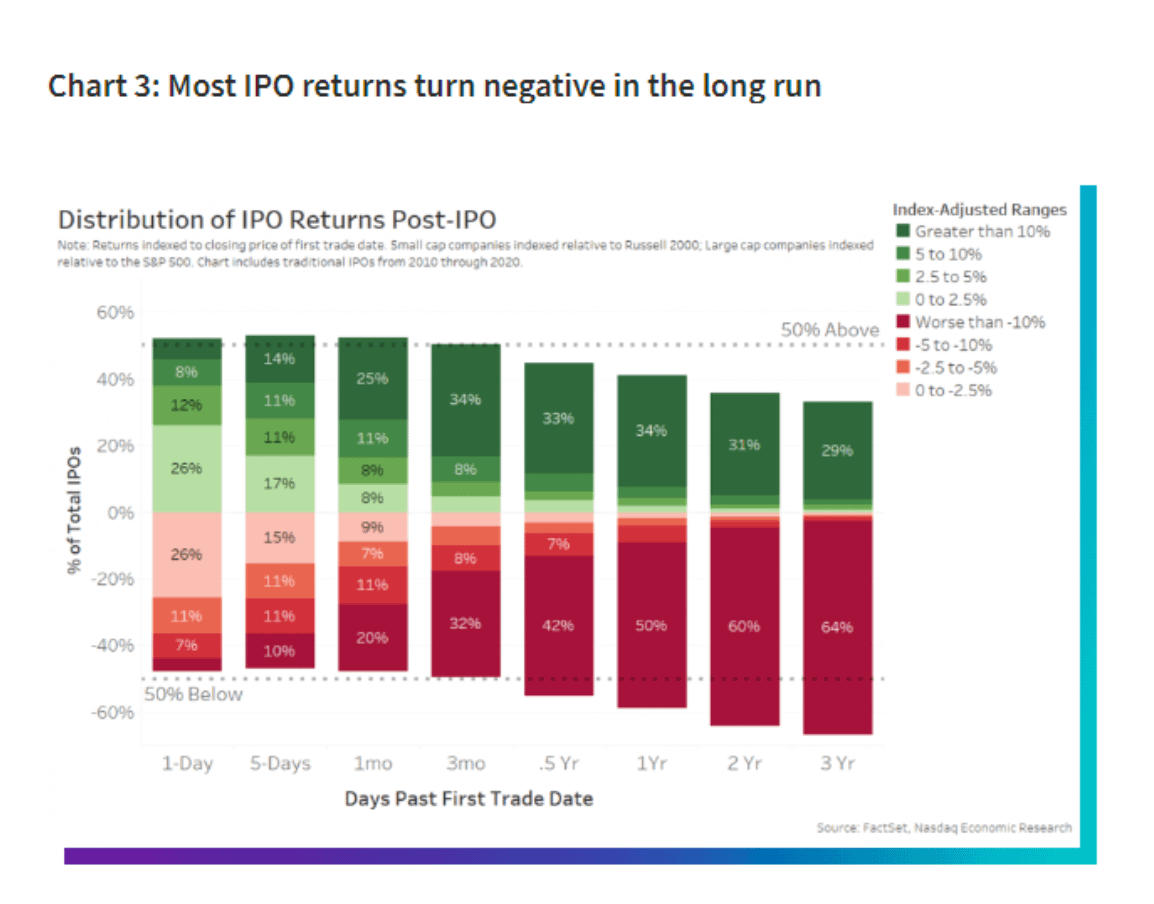

As data from renowned researchers like Professor Jay Ritter of the University of Florida suggests, almost two-thirds of IPOs underperform the broader market within three years of their debut.

While there will always be outliers that defy these odds, and with the media hyping up the next new thing, it’s essential for savvy investors to see beyond the initial hype and carefully assess the company’s fundamentals, growth potential, and the broader market landscape. For many, patience could be the key, waiting for the almost inevitable downward market correction that often follows the initial burst of an IPO.

An Executive Perspective on IPO Benefits and Limitations

Stepping into the limelight of the public market is a double-edged sword for corporations. On one hand, the benefits are tangible: increased capital for growth, enhanced company profile, and access to a global pool of investors. The ability to tap into both equity and debt markets worldwide can offer invaluable leverage in pursuing ambitious projects and expansions.

On the flip side, public status brings unparalleled transparency. Every success is celebrated, but every misstep, flaw, or internal challenge is laid bare for all to see.

One such challenge is the maze of compliance and heightened scrutiny. Laws like the Sarbanes-Oxley Act place significant onus on CFOs and CEOs, requiring meticulous attestations with every filing. This level of transparency can expose them to shareholder lawsuits and various claims that may not be easy to deal with and could distract from the everyday operations of the business.

Furthermore, once a company has gone public, executives must grapple with restrictions on their stock liquidity, such as trading blackout windows, volume constraints, and the potentially damaging perceptions that selling might signal to the market. Such complexities necessitate meticulous planning with wealth advisors, accountants, and corporate counsel.

Beyond the structural challenges, executives must also contend with the pressure of short-term market expectations, often at the expense of long-term vision—a balancing act epitomized by Jeff Bezos when he said: “Friends congratulate me after a quarterly-earnings announcement and say, ‘Good job, great quarter,’ and I’ll say, ‘Thank you, but that quarter was baked three years ago.’ I’m working on a quarter that’ll happen [two or three years into the future] right now.”

Thus, for corporations, going public is not just about immediate gains; it’s about maintaining a delicate equilibrium between meeting present-day market expectations and forging a sustainable path for the future.

The Reality Behind the Hype: A Performance Analysis

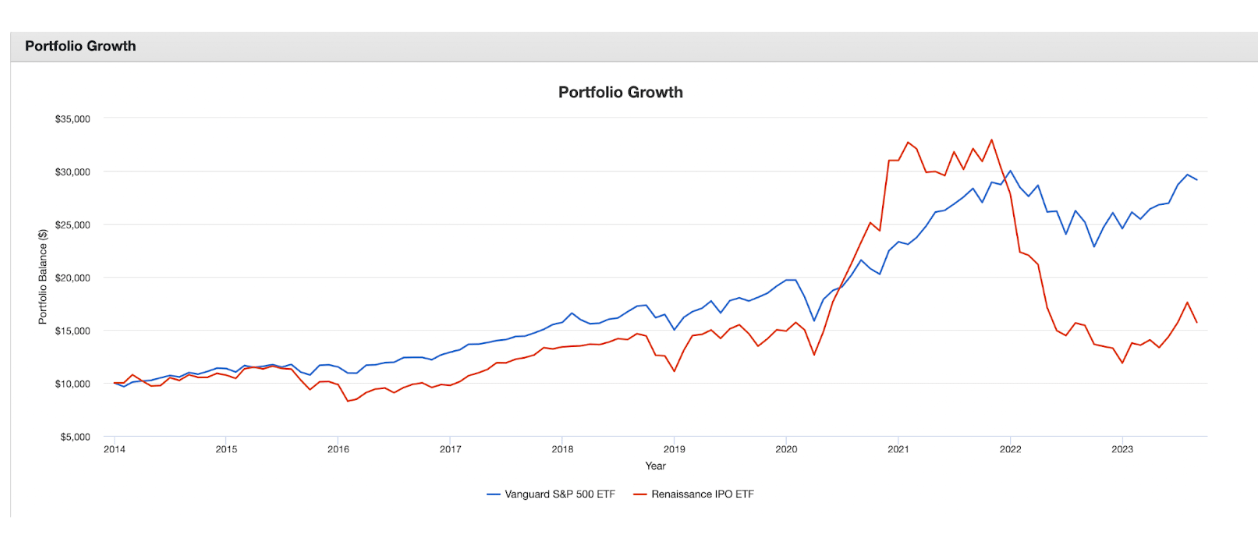

The allure of investing in IPOs often lies in their initial burst of enthusiasm, magnified by a chorus of investment bankers, media outlets, and the echo chamber of social media. This phenomenon, reminiscent of the late ’90s dotcom bubble, seduces many into believing in the promise of immediate returns. However, a deep dive into performance figures paints a more sobering picture. Between January 1, 2014, and July 25, 2023, while the S&P 500 boasted a robust annual return of 11.79%, the Renaissance IPO ETF (which seeks to track U.S. IPOs) trailed with a gain of just 4.79%.

The volatile nature of IPOs becomes even more apparent when considering the typical 90-to-180-day lockup period. As insiders and employees rush to cash in post-lockup, the market often gets saturated with shares, causing prices to dip. With over 6,000 companies having gone public between 2000-2023, the landscape is a testament to the fact that not all IPOs are created equal. While there are success stories that redefine markets, many more fade into obscurity or underperform significantly, as you can see in the chart below.

Ready to Navigate the IPO Landscape? Let’s Chart Your Course Together

Embarking on the IPO journey, whether as an investor or an executive, requires expertise and strategic insight. The world of public offerings is filled with both unprecedented opportunities and significant pitfalls, all of which you should carefully consider beforehand. If your company is preparing for an IPO in the next few months or years, don’t venture alone.

Reach out to us at info@solidaritywealth.com or call 385-374-1665 to schedule a discovery call. Together, we’ll chart the best course of action and set you on a path to success.

About Jeff

For over a dozen years, Jeff has advised some of the country’s most successful families on all aspects of their wealth. With his background as a former tax and estate planning attorney at a prominent Houston, Texas law firm, Jeff has advised clients through business sales, funding rounds, IPOs, complex tax and wealth planning transactions, private and public market investments, executive compensation packages, succession planning, and much more. In short, Jeff helps clients navigate the unique challenges that come with building wealth and helps them better predict their financial future.

In addition to co-founding Solidarity Wealth, Jeff advises single family offices on a broad array of challenges. Jeff also serves as the Managing Partner of Solidarity Capital, an income fund managed separately by the Solidarity partners.

Jeff is a sought after thought leader on a wide range of tax, finance, and estate planning topics. Jeff has been quoted in Yahoo!Finance and Kiplinger’s, has published in diverse publications from Silicon Slopes Magazine to the Taxation of Exempts Journal by Thomson Reuters, and has spoken to audiences ranging from the Estate Planning Section of the Utah State Bar to the Nonprofit Organizations Institute to large company conferences.

Jeff holds a bachelor’s degree in accounting from Brigham Young University – Idaho and a Juris Doctor, with honors, from the University of Texas School of Law. Outside of work, Jeff is married and the father of three amazing children. He has also served as past President of the Salt Lake Estate Planning Council.

Solidarity Wealth is a registered investment adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Solidarity Wealth and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Solidarity Wealth unless a client service agreement is in place.